Audit Procedures for Cash and Cash Equivalents

Cash and Cash Equivalents for Year Ended June 30 In Thousands Carrying Amount 2012 2011 2010 Cash in bank 56362 60809 46487. These procedures must include documentation by shift session or.

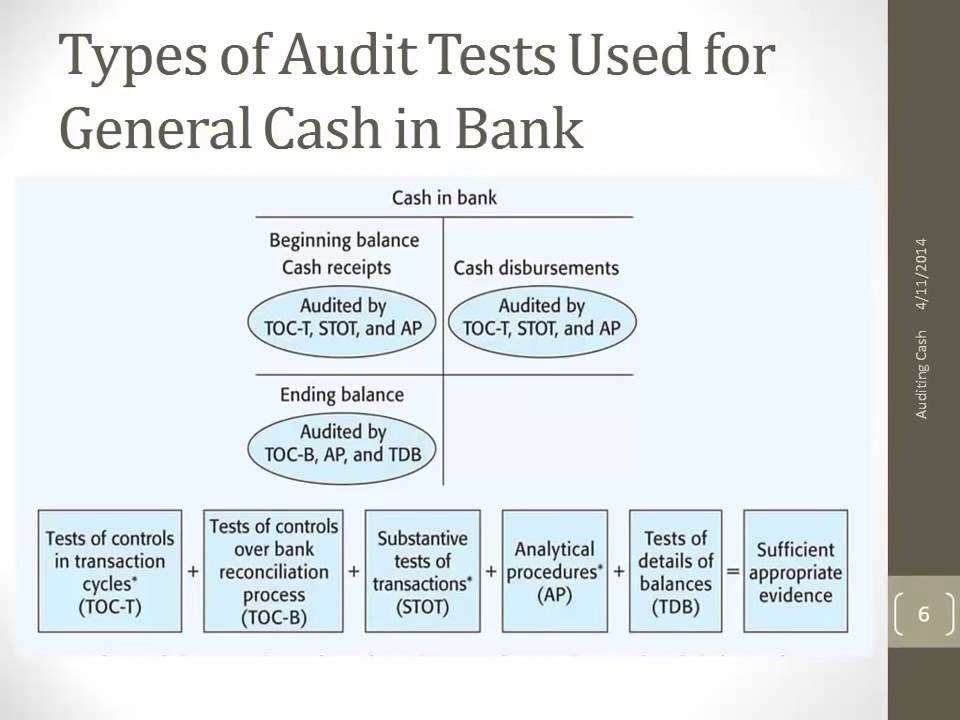

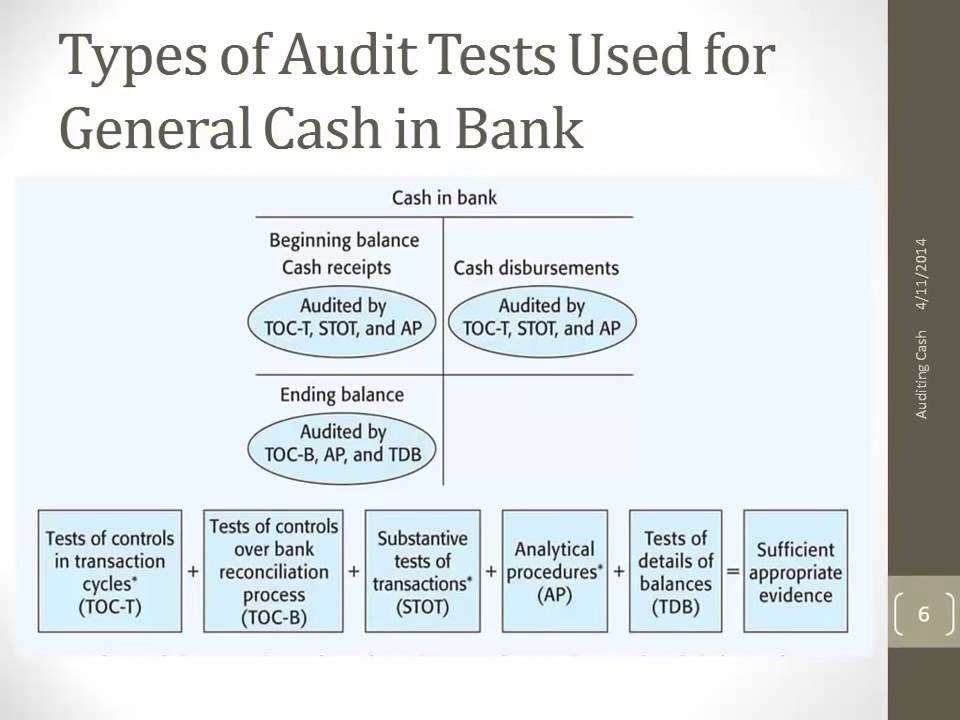

Types Of Audit Tests Used For General Cash In Bank Youtube

Get 247 customer support help when you place a homework help service order with us.

. Or the statement which shows the total cash inflow and outflow of an Organization is termed as cash flow statement. Audit committee means a committee established under section19. Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities.

3 Cash Flow Statement. Auditor about whether the financial statements present a true fair view of the state of affairs of the entity profitloss of the entity cash flows for the year and such opinion is given after performing reasonable audit procedures so obtain sufficient appropriate evidence for the assurance. 2 Procedures must be implemented to control cash or cash equivalents based on the amount of the transaction.

All cash and bank audit procedures need to be properly documented and all. Note that local governments with total revenues of 2 million or less are not required to prepare financial statements unless debt covenants a contract a grantor or the districts legislative body requires the district to prepare the financial. LBI Industry Guidance 04-0118-007 dated 212018 established procedures to ensure waiver requests are applied in a fair consistent and timely manner under the regulations.

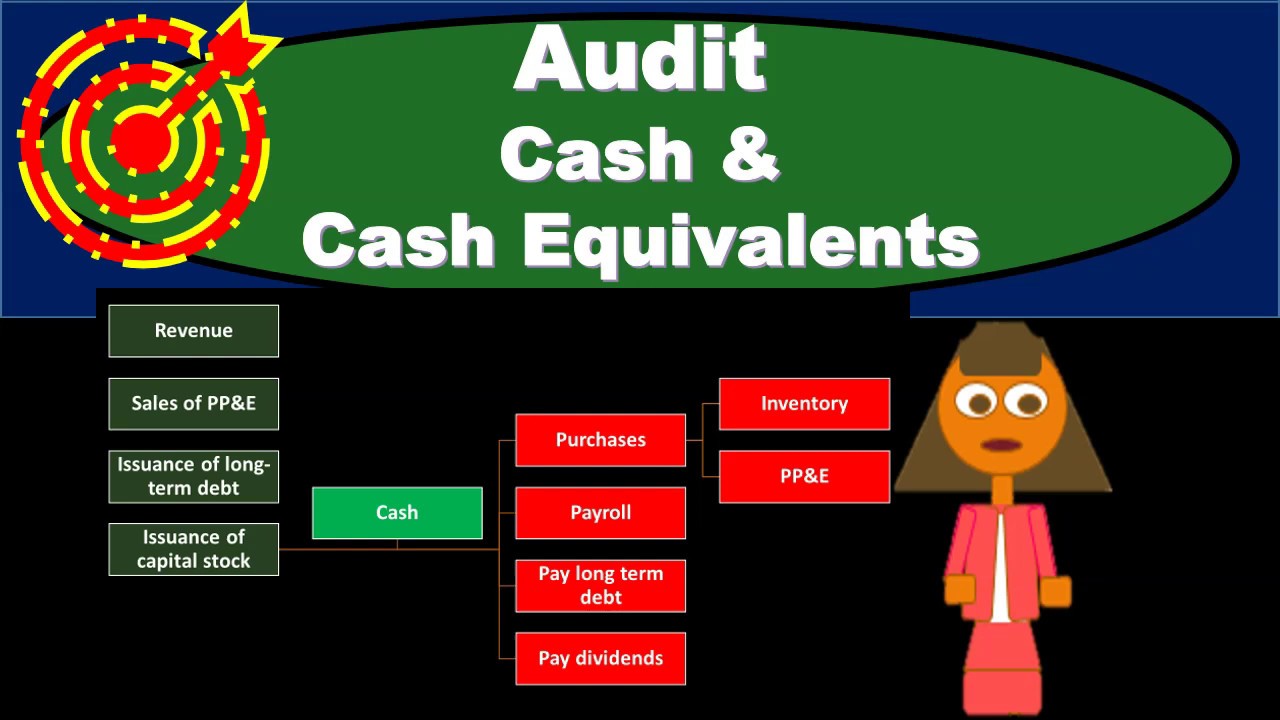

This is a statement of the companys cash and cash equivalents Cash And Cash Equivalents Cash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. This will help the auditor to plan audit procedures for cash and cash equivalents. Internal control includes corporate governance company policies segregation of duties authorized approvals for purchases designated signature authority with limits payments reconciliation and bank.

Automatically generate reports for regulators and partners. 41530 The SAO online filing system will automatically produce the C-4 and C-5 statements for the local governments. Through an examination treatment stream this campaign will concentrate on bringing into compliance those.

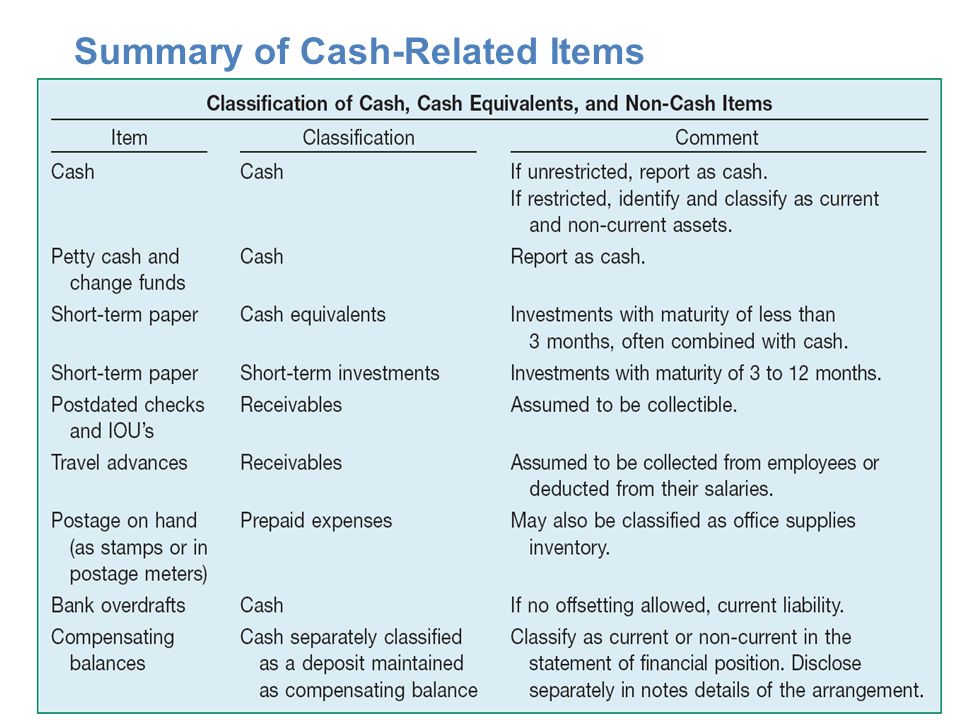

Cash equivalents are short-term balances with an original maturity of three months or less from the date of deposit highly liquid investments that are readily convertible into known amounts of cash and which are subject to insignificant risk of changes in value. Cash Equivalents For purposes of the statement of cash flows the Company considers all highly liquid debt instruments with a maturity of three months or less to be cash equivalents. In Cash and Cash Equivalents there are two separate components.

Has audited Income Statement Balance Sheet Cash Flow Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. For taxable years beginning January 1 2018 the tax treatment of all items in a partnership return is governed by rules established by BBA. Auditor-General means the Auditor-General appointed in accordance with the Constitution.

MTA control environment was insufficient to safeguard and detect actual or suspected loss of cash and cash equivalents. An audit report is an independent opinion of a personfirm ie. It includes cash on hand demand deposits and other items that are unrestricted for use in the current operations.

Cash and paper money US Treasury bills undeposited receipts. For the seller revenue can be revised by debiting the sales return account A contra account by nature and crediting cashaccounts receivable with the invoice amount. A Form 1099 Information Return or its foreign equivalents.

05 DARRELL JOE O. They will need to get idea about the number of banks types of bank accounts authorized signatories authorization matrix bank payment process petty cash payment process etc. Cash and Cash Equivalent is scoped under IAS 7 Statements of Cash Flows.

The second is Cash Equivalents which are investments that are short-term highly liquid and are readily convertible to. Cash purchases and sales of cash and cash equivalents. Bank account means an account at a bank into which moneys are deposited and drawn.

Regulation C Rule 405. 11405 Audit Requirement for Non. Assets consisting of any amount of cash and cash equivalents and nominal other assets.

Unverified transfers of cash or cash equivalents are prohibited. Recommendation 31 We recommend Mass Transit management ensure physical security over manual receipts cash and cash equivalents eg bus tickets bus passes taxi coupons. Controlling cash receipts and cash disbursements reduces erroneous payments theft and fraud.

IntroductionThe purpose of this handbook is to establish and document the flow of cash and cash receipts and provide guidelines for the proper management of monies for those employees responsible for receiving handling and safeguarding cash and cash equivalentsThe custodian of every cash fund is responsible for the integrity of the cash fund. A cash base statement that shows the changes in the balance sheet and Income statement that affect cash cash equivalents. Help your team handle сompliance.

Here is the sale return journal entry. Multiple series registrants should include in the controls and procedures disclosure of their periodic reports a statement that the CEOCFO certifications are applicable to each of the. 1 Page 1 of 17 AUD Handouts No.

It proves to be a prerequisite for analyzing the business. Here we discuss Types of Audit report opinion and Sample Audit Report examples including Facebook Tesco Plc. Accounts Receivable Trade accounts receivable are stated net of an allowance for doubtful accounts of 7500 at December 31 20YY and 20XX.

ASUNCION CPA MBA DEFINITION OF CASH Cash includes money and other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. Cash resources means cash in form of Bank notes or coins. Cash control is cash management and internal control over cash.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 26 Cash flow statement Cash flows are reported using the indirect method. The Bipartisan Budget Act of 2015 BBA repealed the TEFRA partnership procedures including the electing large partnership provisions and replaced them with a new centralized partnership audit regime.

Automate processes construct unique verification flows and investigate cases in-depth all in a few clicks. The first is cash which comprises cash on hand and at the bank. Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales.

Auditing Cash and Cash. As noted in Table 2 the system had approximately 114 million in cash and cash equivalents in local bank accounts and approximately 793 million in the state treasury at June 30 2012.

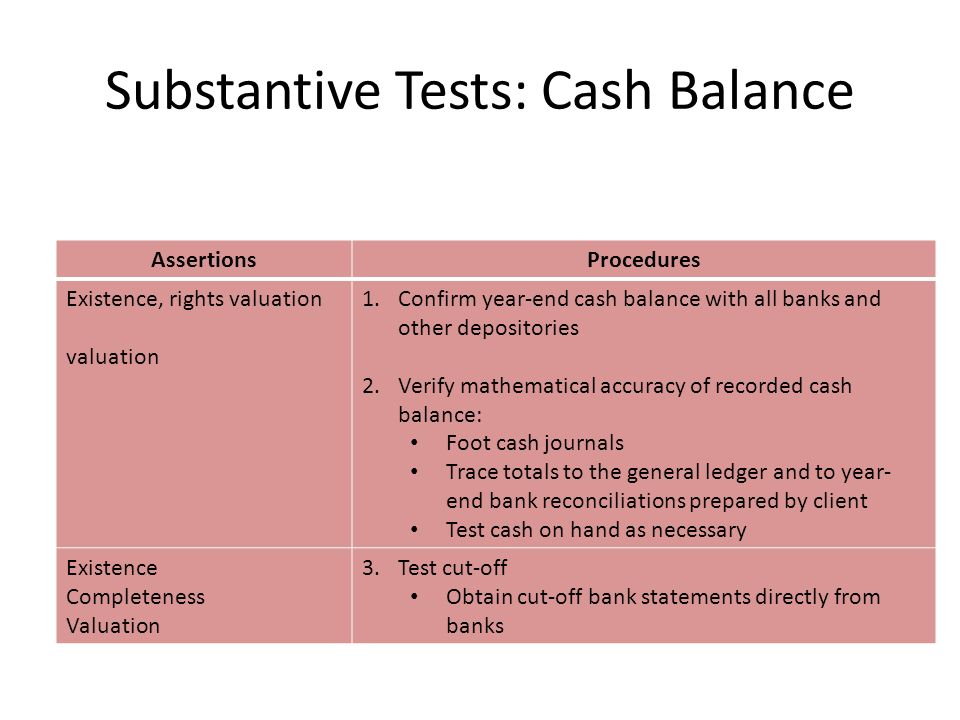

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

Audit Of Cash And Bank Balances

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

Audit Cash Cash Equivalents Youtube

0 Response to "Audit Procedures for Cash and Cash Equivalents"

Post a Comment